Syed Shayan Real Estate Archive

From Real Estate History

On October 27, 1835, the first official institutional mortgage system emerged in the United States through 'Terminating Building Societies' (TBS), marking a revolutionary shift from informal property transactions to structured home financing. These societies pooled member resources to provide systematic mortgage lending, establishing foundational principles for modern banking. The TBS model introduced standardized loan terms, collective risk management, and formalized property ownership pathways that would evolve into contemporary mortgage institutions. This innovation democratized homeownership access and created the architectural framework for today's complex real estate financing systems that continue to shape property markets worldwide.

▪ Reference(s):

27 اکتوبر 1835 کو، پہلا باضابطہ انسٹیٹیوشنل مارگیج سسٹم 'Terminating Building Societies' (TBS) کے ذریعے امریکہ میں ابھرا، جو غیر رسمی پراپرٹی لین دین سے منظم ہوم فنانسنگ کی طرف ایک انقلابی تبدیلی کی نشاندہی کرتا ہے۔ ان سوسائٹیز نے رکن وسائل کو جمع کیا تاکہ منظم رہن قرضے دینے کی فراہمی کی جا سکے، جو جدید بینکنگ کے لیے بنیادی اصول قائم کرتی ہیں۔

On October 27, 1994, the Federal Reserve's aggressive interest rate hikes significantly pressured the US housing market, demonstrating the powerful connection between monetary policy and real estate activity. The series of rate increases throughout 1994 translated directly into higher mortgage rates, slowing home sales, reducing refinancing activity, and moderating price appreciation nationwide. This period became a classic case study in achieving a 'soft landing' for overheated housing markets through calibrated monetary tightening. The Fed's actions successfully cooled speculative excesses without triggering a severe downturn, establishing important precedents for using interest rates as tools to manage real estate cycles and prevent housing bubbles.

▪ Reference(s):

27 اکتوبر 1994 کو، فیڈرل ریزرو کے جارحانہ سود کی شرح میں اضافے نے امریکی ہاؤسنگ مارکیٹ پر نمایاں دباؤ ڈالا، جو مانیٹری پالیسی اور رئیل اسٹیٹ کی سرگرمی کے درمیان طاقتور کنکشن کا مظاہرہ کرتا ہے۔ 1994 کے دوران شرح میں اضافے کی سیریز براہ راست اعلی رہن کی شرحوں میں ترجمہ ہوئی، جس نے گھروں کی فروخت کو سست کیا، دوبارہ مالی اعانت کی سرگرمی کو کم کیا، اور قومی سطح پر قیمت کی قدر کو معتدل کیا۔

On October 27, 2019, Pakistan's Real Estate Regulatory Authority (RERA) became fully operational, marking a significant milestone in the country's property market regulation. The authority established comprehensive frameworks for project registration, developer accountability, and consumer protection in the real estate sector. RERA introduced mandatory project approvals, escrow account requirements, and standardized sale agreements to protect homebuyers from fraudulent practices and construction delays. This regulatory transformation aimed to enhance market transparency, boost investor confidence, and establish professional standards in Pakistan's rapidly growing property sector. The authority's operationalization represented a major step toward formalizing real estate transactions and creating a more secure environment for property investments nationwide.

▪ Reference(s):

27 اکتوبر 2019 کو، پاکستان کی رئیل اسٹیٹ ریگولیٹری اتھارٹی (RERA) مکمل طور پر آپریشنل ہوئی، جو ملک کی پراپرٹی مارکیٹ ریگولیشن میں ایک اہم سنگ میل کی نشاندہی کرتی ہے۔ اتھارٹی نے پراجیکٹ رجسٹریشن، ڈویلپر کی جوابدہی، اور رئیل اسٹیٹ سیکٹر میں صارف کے تحفظ کے لیے جامع فریم ورکس قائم کیے۔ RERA نے لازمی پراجیکٹ کی منظوری، اسکرو اکاؤنٹ کی ضروریات، اور معیاری سیل معاہدے متعارف کروائے تاکہ گھر خریداروں کو فراڈ کے طریقوں اور تعمیراتی تاخیر سے بچایا جا سکے۔

On October 27, 2020, Pakistan launched its first comprehensive smart city project in Islamabad, representing a major advancement in urban development and real estate innovation. The project integrated digital infrastructure, smart utilities, automated traffic management, and sustainable energy solutions to create a model for future urban planning. This initiative attracted significant foreign investment and established new standards for modern residential and commercial development in Pakistan. The smart city concept incorporated advanced technologies for efficient resource management, enhanced security systems, and improved quality of life for residents while setting benchmarks for sustainable urban development that could be replicated in other Pakistani cities.

▪ Reference(s):

27 اکتوبر 2020 کو، پاکستان نے اسلام آباد میں اپنا پہلا جامع سمارٹ سٹی پروجیکٹ لانچ کیا، جو شہری ترقی اور رئیل اسٹیٹ انوویشن میں ایک بڑی پیشرفت کی نمائندگی کرتا ہے۔ پراجیکٹ نے ڈیجیٹل انفراسٹرکچر، سمارٹ یوٹیلیٹیز، آٹومیٹڈ ٹریفک مینجمنٹ، اور پائیدار توانائی کے حل کو یکجا کیا تاکہ مستقبل کی شہری منصوبہ بندی کے لیے ایک ماڈل تخلیق کیا جا سکے۔

On October 27, 2022, Pakistan achieved a major milestone in property registration digitalization, significantly reducing processing times and enhancing transaction transparency. The comprehensive digital transformation included online property registration, electronic document verification, and blockchain-based title management systems. This modernization eliminated traditional bureaucratic hurdles, reduced opportunities for fraudulent practices, and created more efficient property transaction processes. The digital platform integrated various government databases, enabling real-time verification of property records and ownership details. This technological advancement represented a crucial step toward creating a more transparent, efficient, and secure real estate market in Pakistan while establishing foundations for future innovations in property technology.

▪ Reference(s):

27 اکتوبر 2022 کو، پاکستان نے پراپرٹی رجسٹریشن کی ڈیجیٹلائزیشن میں ایک اہم سنگ میل حاصل کیا، جس نے پروسیسنگ کے اوقات کو نمایاں طور پر کم کیا اور لین دین کی شفافیت کو بہتر بنایا۔ جامع ڈیجیٹل تبدیلی میں آن لائن پراپرٹی رجسٹریشن، الیکٹرانک دستاویز کی تصدیق، اور بلاک چین پر مبنی عنوان کے انتظام کے نظام شامل تھے۔

On November 3, 1993, the implementation of the Maastricht Treaty revolutionized European real estate markets by establishing the framework for a unified property investment zone. The treaty's provisions for free movement of capital and persons enabled cross-border property ownership and investment across EU member states. This led to the emergence ...

Read More →

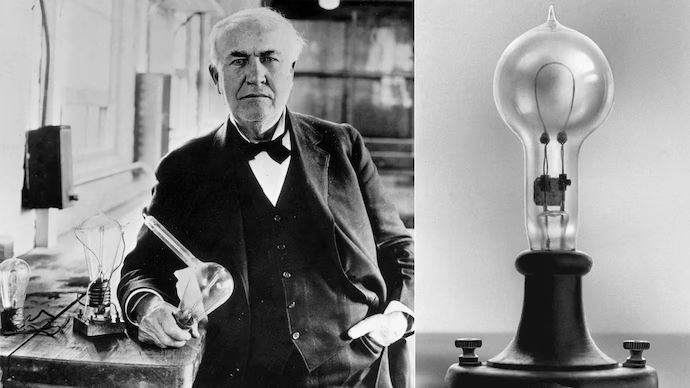

Although Thomas Edison had already developed the electric light bulb in 1879 and had illuminated public spaces on a commercial scale in New York through the Pearl Street Power Station in 1882, the use of electricity at that stage remained limited to a small number of buildings and confined areas. On 19 January 1883, in the town of Roselle, New Jer...

Read More →

On 13 January 1849 the British government transferred the administration of Vancouver Island to the Hudson’s Bay Company, marking a distinctive moment in colonial governance. Instead of assuming direct control, the Crown delegated authority to a private commercial enterprise. The company was authorised to establish administrative order, distribut...

Read More →

On 24 January 1965, the historic Sardar Mahal, located in Hyderabad, was placed under official municipal control following the failure to clear outstanding property tax dues. After the takeover, the premises were repurposed for municipal administrative use. The action was carried out by the Hyderabad Municipal Corporation, which was later reorgani...

Read More →

On October 21, 1959, Pakistan launched its first House Building Finance Scheme through the House Building Finance Corporation (HBFC). This initiative aimed to provide affordable housing loans to the middle class at subsidized interest rates. The scheme significantly boosted residential construction in urban areas and enabled thousands of families t...

Read More →

The acquisition of land for the Model Town Society was one of the most remarkable and spirited chapters in its early history. Dewan Khem Chand and his...

Between 1921 and 1924, the land for Model Town Lahore was acquired in successive phases. The process began in 1921, shortly after the establishment of...

No comments yet. Be the first to comment!