Syed Shayan Real Estate Archive

From Real Estate History

On October 26, 1933, the US New Deal introduced transformative housing reforms during the Great Depression. The Home Owners' Loan Corporation (HOLC) and Federal Housing Administration (FHA) were established to prevent foreclosures, stabilize property values, and introduce long-term amortized mortgages. These initiatives revolutionized home financing by creating government-backed mortgage insurance, standardizing lending practices, and making homeownership accessible to millions. The reforms established federal oversight in housing markets, shifted risk from local banks, and laid the foundation for modern mortgage systems that would fuel post-war suburban expansion and shape American housing policy for decades.

▪ Reference(s):

26 اکتوبر 1933 کو، امریکی نیو ڈیل نے عظیم کساد بازاری کے دوران تبدیلی لانے والی ہاؤسنگ اصلاحات متعارف کروائیں۔ ہوم اوونرز لون کارپوریشن (HOLC) اور فیڈرل ہاؤسنگ ایڈمنسٹریشن (FHA) قائم کیے گئے تاکہ فورکلوژرز کو روکا جا سکے، پراپرٹی ویلیو کو مستحکم کیا جا سکے، اور طویل مدتی امورٹائزڈ رہن متعارف کروائے جا سکیں۔ ان اقدامات نے حکومتی حمایت یافتہ رہن انشورنس بنا کر، قرض دینے کے طریقوں کو معیاری بنا کر، اور لاکھوں لوگوں کے لیے گھر کی ملکیت کو قابل رسائی بنا کر ہوم فنانسنگ میں انقلاب برپا کیا۔

On October 26, 2005, the US housing bubble reached its zenith, marking the peak of unsustainable price growth that would soon trigger the global financial crisis. Property values had soared to unprecedented levels driven by speculative investments, subprime lending practices, and financial innovations that masked underlying risks. The market showed clear signs of overheating with inflated valuations, excessive leverage, and deteriorating lending standards. This peak represented the culmination of years of irresponsible lending and speculative mania that would soon unravel, leading to massive foreclosures, bank failures, and the most severe economic downturn since the Great Depression.

▪ Reference(s):

26 اکتوبر 2005 کو، امریکی ہاؤسنگ بلب اپنے عروج پر پہنچا، جو غیر پائیدار قیمتوں کی نمو کے عروج کی نشاندہی کرتا ہے جو جلد ہی عالمی مالیاتی بحران کو متحرک کرے گا۔ پراپرٹی ویلیو قیاس آرائی کی سرمایہ کاری، سب پرائم قرضے دینے کے طریقوں، اور مالیاتی اختراعات کی وجہ سے غیر معمولی سطحوں تک پہنچ گئی تھی جو بنیادی خطرات کو چھپا رہی تھیں۔

On October 26, 2012, the Federal Reserve's quantitative easing programs significantly accelerated the US real estate recovery from the financial crisis. By purchasing mortgage-backed securities and keeping interest rates at historic lows, the Fed injected substantial liquidity into housing markets, making mortgages more affordable and stimulating property demand. These unprecedented monetary interventions helped stabilize falling home prices, reduced foreclosure rates, and restored confidence in real estate markets. The programs demonstrated the powerful role central banks could play in supporting property markets during economic crises and established new precedents for monetary policy interventions in housing sectors.

▪ Reference(s):

26 اکتوبر 2012 کو، فیڈرل ریزرو کے کوانٹیٹیو ایزنگ پروگرامز نے مالیاتی بحران سے امریکی رئیل اسٹیٹ کی بحالی کو نمایاں طور پر تیز کیا۔ مارگیج بیکڈ سیکیورٹیز خریدنے اور سود کی شرحیں تاریخی حد تک کم رکھنے کے ذریعے، فیڈ نے ہاؤسنگ مارکیٹس میں کافی لیکویڈیٹی انجیکٹ کی، جس سے رہن زیادہ سستی ہو گئی اور پراپرٹی کی مانگ میں اضافہ ہوا۔

On October 26, 2018, blockchain technology began transforming real estate transactions through pilot programs testing property tokenization and smart contracts. This innovation promised to revolutionize property ownership transfers, title management, and transaction recording by creating immutable, transparent digital ledgers. Early adopters explored using blockchain for reducing fraud, streamlining closing processes, and enabling fractional property ownership through tokenization. While still in experimental stages, these initiatives demonstrated blockchain's potential to increase transaction security, reduce costs, and create new investment opportunities in real estate markets worldwide.

▪ Reference(s):

26 اکتوبر 2018 کو، بلاک چین ٹیکنالوجی نے پراپرٹی ٹوکنائزیشن اور سمارٹ کنٹریکٹس کی جانچ کے پائلٹ پروگراموں کے ذریعے رئیل اسٹیٹ لین دین کو تبدیل کرنا شروع کیا۔ اس اختراع نے ناقابل تغیر، شفاف ڈیجیٹل لیجرز بنا کر پراپرٹی کی ملکیت کی منتقلی، عنوان کے انتظام، اور لین دین کی ریکارڈنگ میں انقلاب برپا کرنے کا وعدہ کیا۔

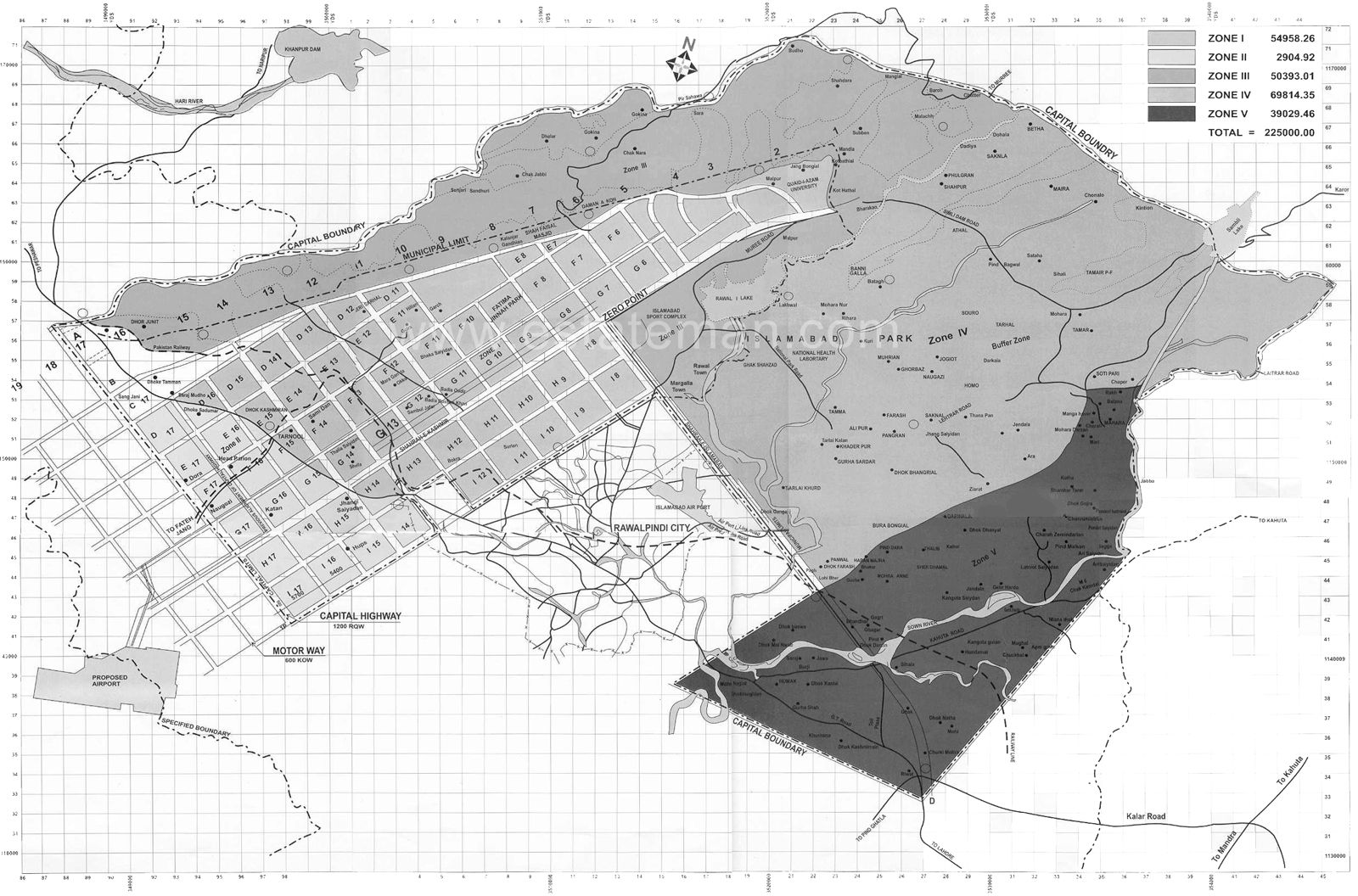

On this date, the Capital Development Authority formally approved the first sector boundary map for Pakistan’s newly designated federal capital, Islamabad. The authorisation marked one of the earliest and most consequential administrative steps taken by the newly formed authority, which had been established in June 1960 under the direction of Pre...

Read More →

On November 1, 2016, Pakistan inaugurated the Gwadar Free Zone under the China-Pakistan Economic Corridor (CPEC), marking a milestone in regional industrial growth. The project aimed to transform Gwadar into a global logistics and manufacturing hub connecting South Asia, the Middle East, and Africa. The zone offered tax holidays, investor incentive...

Read More →

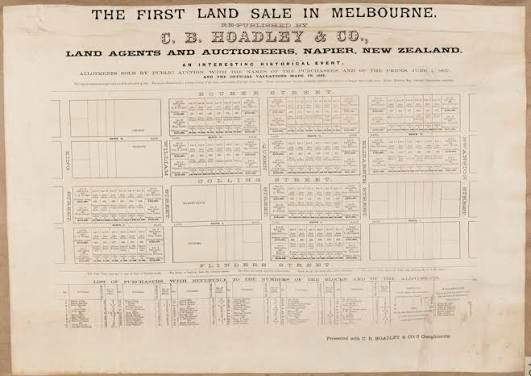

On October 10, 1885, Melbourne witnessed one of the most significant property events in its urban history when the city hosted its first large scale public land auction in the growing suburbs south of the Yarra River. At that time, Melbourne was experiencing a remarkable economic and population boom driven by gold rush prosperity, migration, and in...

Read More →

On October 27, 1835, the first official institutional mortgage system emerged in the United States through 'Terminating Building Societies' (TBS), marking a revolutionary shift from informal property transactions to structured home financing. These societies pooled member resources to provide systematic mortgage lending, establishing foundational p...

Read More →

One hundred years ago, on 16 January 1926, leading English language newspapers published in Bombay, including The Times of India, Bombay Chronicle, and The Bombay, reported on an official debate held during a major government session in British India. These reports recorded that the Bombay Legislative Council had engaged in a detailed discussion on...

Read More →

The acquisition of land for the Model Town Society was one of the most remarkable and spirited chapters in its early history. Dewan Khem Chand and his...

Between 1921 and 1924, the land for Model Town Lahore was acquired in successive phases. The process began in 1921, shortly after the establishment of...

No comments yet. Be the first to comment!