From Real Estate History

23 December

23 December 1925

The Florida Land Boom of the 1920s The Florida Land Boom is widely regarded as the first major speculative bubble of the modern real estate era, a period when land could change hands several times within a single day, each transaction multiplying its price

Exactly one century ago, on 23 December 1925, the most famous real estate phenomenon in American history stood at its absolute peak. Across Florida, particularly in Miami and Palm Beach, the purchase of land had transformed into a national obsession. The promise was simple and intoxicating: fortunes could be made overnight.

At the height of the boom, even the smallest plots in virtually any district of these cities could double in value within hours. Buyers routinely paid advances without inspecting the land, and in many cases plots were resold for profit even before formal registration was completed. Real estate agents, investors, and ordinary citizens alike were swept into the frenzy, united by a shared conviction that prices would never fall.

Contemporary newspaper reports from December 1925, most notably the 23 December edition of The Miami Herald, describe scenes bordering on the extraordinary. Despite the Christmas holidays, thousands queued to purchase land. Railway stations, ports, and land offices were overwhelmed, while civic systems struggled to cope with the sheer volume of speculative activity.

Economic historians have since identified this episode as the first great real estate bubble of the modern age. Land values were no longer determined by housing needs or economic fundamentals, but by speculation, rumour, and the pursuit of rapid profit.

The boom, however, proved unsustainable. In 1926, a devastating hurricane struck Florida, destroying vast areas and shattering investor confidence almost overnight. Economic strains quickly followed, land prices collapsed with remarkable speed, and the Florida Land Boom, once celebrated worldwide as a symbol of opportunity and prosperity, became a lasting cautionary tale in real estate history.

When examined plainly, the underlying story is unmistakably clear.

Following the First World War, the United States experienced a surge in wealth. Automobiles became commonplace, railways and advertising compressed distances, and Florida was marketed as a dreamland where sunshine, oceanfront living, and rapidly expanding cities promised universal prosperity. In Miami and Palm Beach in particular, land was no longer acquired for settlement but for immediate resale.

Plots were purchased without inspection, without maps, and often without any understanding of location, driven solely by hearsay and expectations of rising prices. A plot acquired in the morning could pass through several owners by evening. Land ceased to function as an asset rooted in utility and instead became a certificate of anticipated wealth, sustained by the collective belief that prices could only rise.

The fundamental weakness of the system lay in the absence of genuine end users. Most buyers had no intention of building homes or establishing communities. They were merely waiting for the next purchaser. Once the flow of new buyers slowed, the structure began to falter. By late 1925, rail networks were paralysed, not by building materials, but by the transport of land documents. Banks began to restrict lending, buyers disappeared, and for the first time prices stagnated. These were the early signs of collapse.

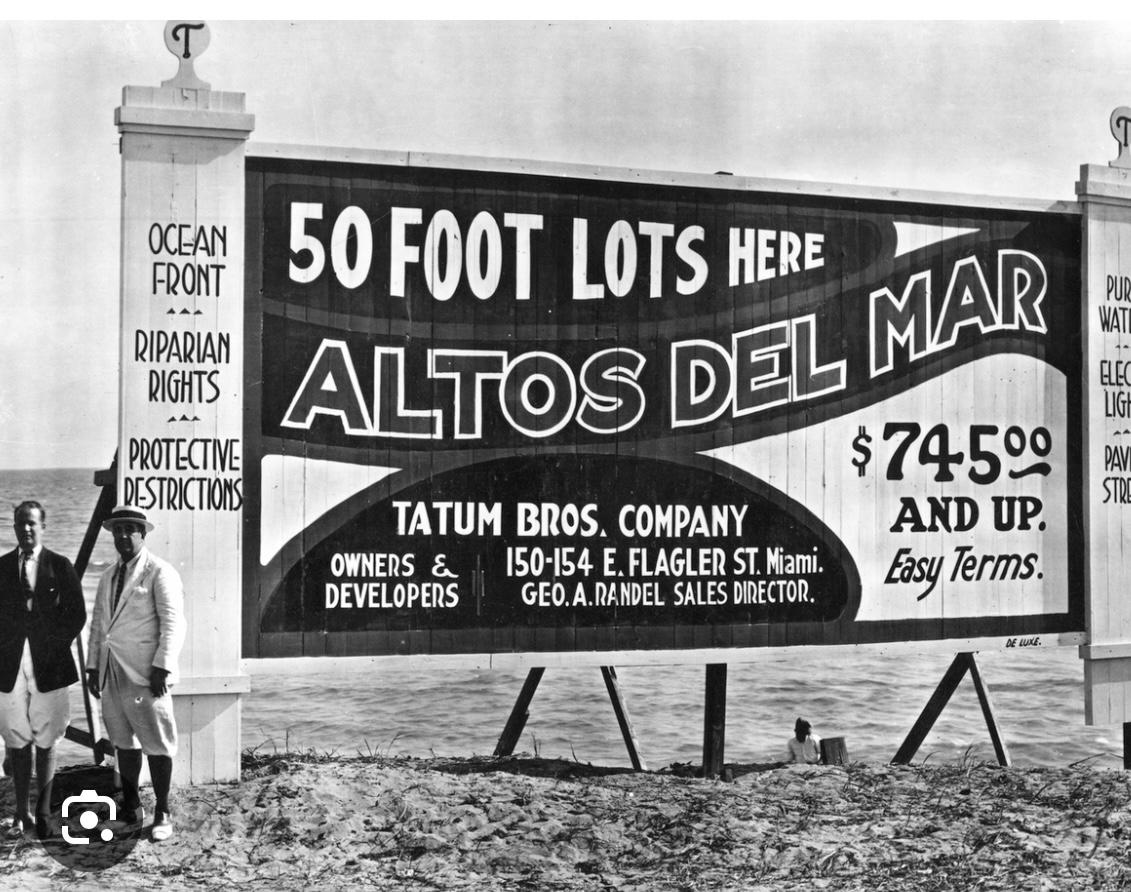

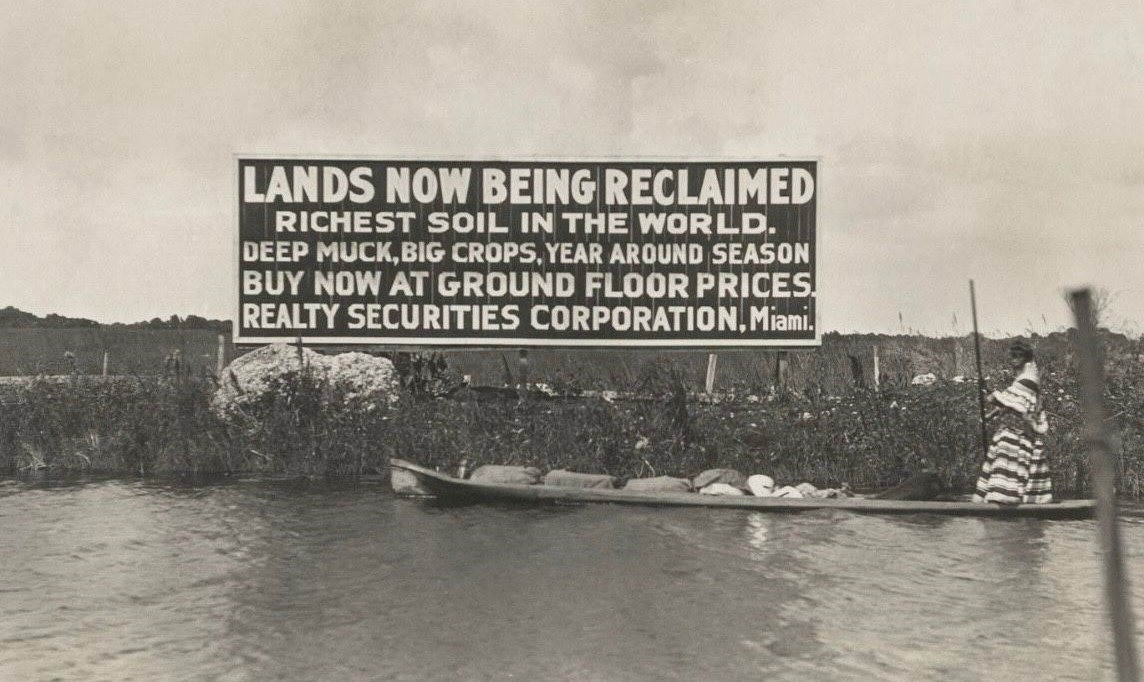

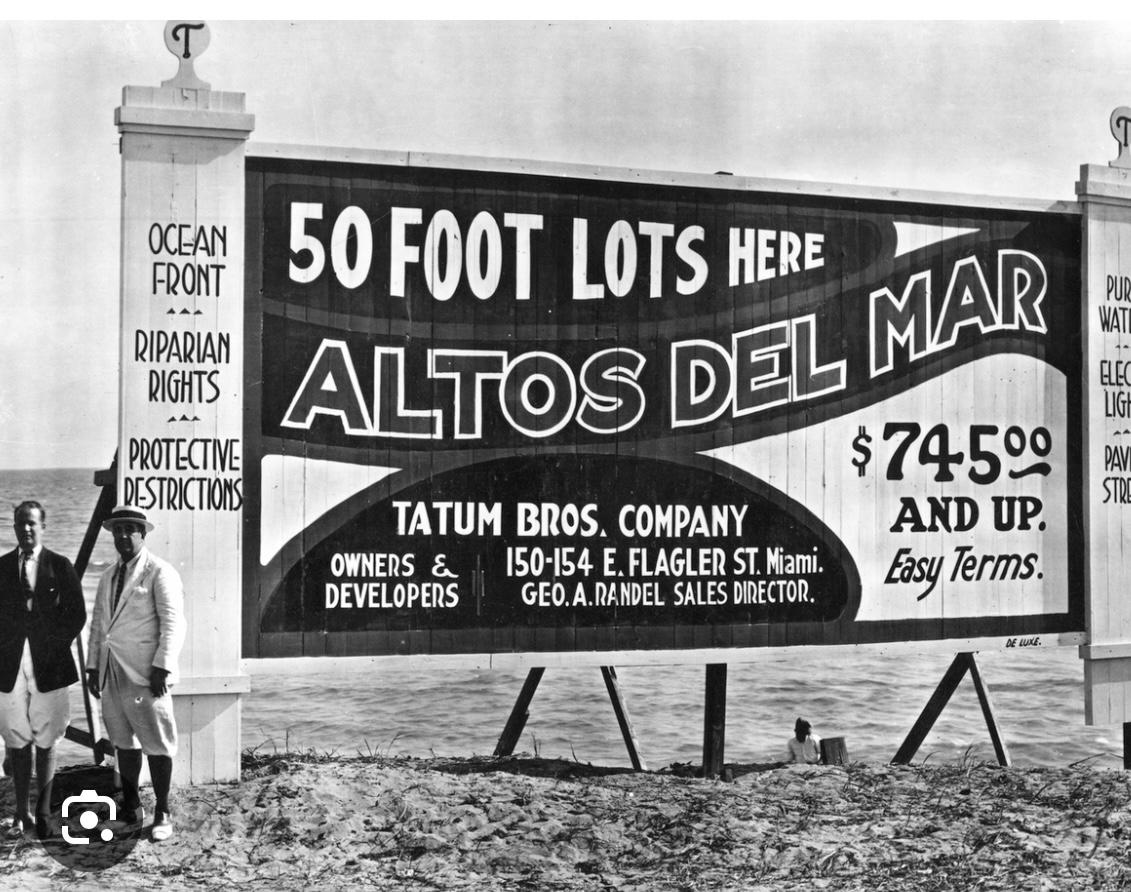

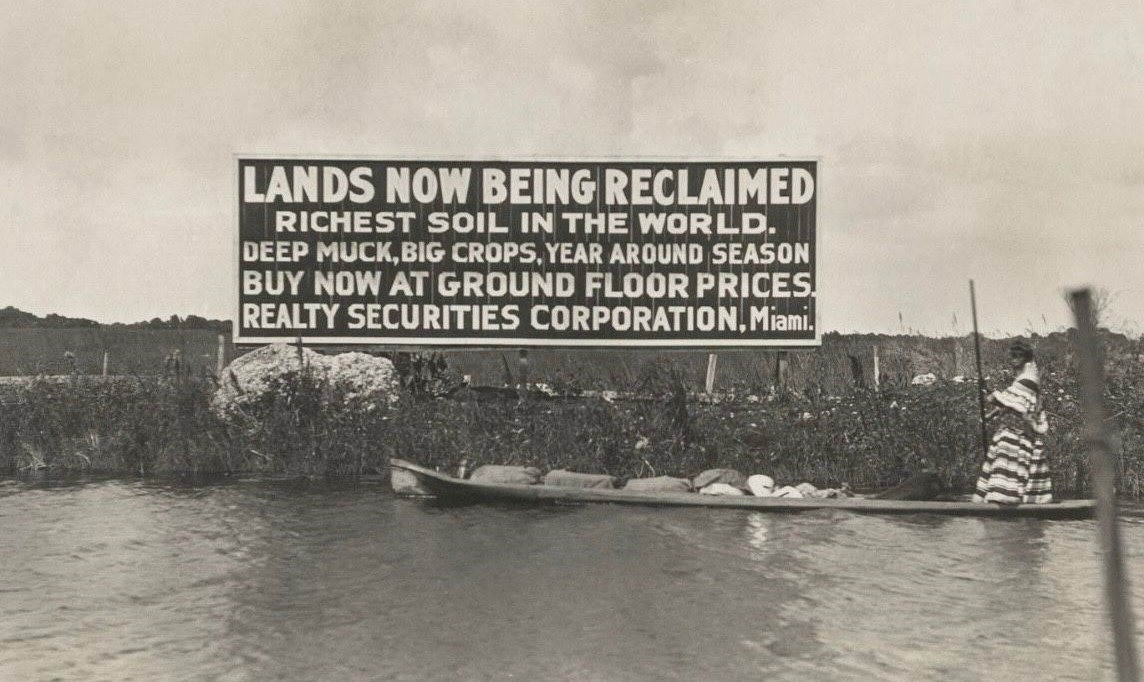

This board is a striking example of the deceptive advertising that characterised the Florida Land Boom. Swamp land and waterlogged areas were promoted as “reclaimed land” and boldly described as “the richest soil in the world.” The purpose of such language was not to reflect the land’s actual condition, but to convince buyers that an immediate purchase would yield rapid profits. In reality, most of these plots were neither properly drained nor suitable for housing or cultivation. Yet slogans such as “buy now at ground floor prices” were used to intensify speculation. This form of misleading promotion played a central role in inflating the Florida Land Boom into a speculative bubble, which ultimately left thousands of investors facing heavy financial losses.

Two decisive developments in 1926 rendered the decline irreversible. First, a powerful hurricane struck Miami, destroying thousands of structures, crippling ports, and exposing the reality that the city had been sold far faster than it had been built, secured, or prepared. Second, confidence among banks and developers evaporated. As payments ceased and instalments defaulted, the very documents once regarded as wealth became liabilities. Countless individuals who had purchased land through borrowed funds lost everything.

The outcome was severe. In many areas, land values fell by fifty to seventy percent. Thousands of projects were abandoned, banks failed, and Florida’s economy was set back for years. Crucially, all of this occurred three years before the Great Depression of 1929. For this reason, scholars consistently identify the Florida Land Boom as the first modern speculative real estate bubble, containing all the defining elements later repeated across the world: purchases driven by rumour, the absence of real demand, faith in effortless profit, and the sudden collapse of systemic confidence.

The enduring lesson of the Florida Land Boom is unmistakable. Land was stripped of its function as shelter and long-term asset and transformed into a vehicle for rapid speculation. When buyers place their faith solely in the next buyer and abandon underlying use, prices may rise, but they cannot endure. This principle lies at the heart of why the episode is still taught in universities across the United States and beyond, within disciplines such as real estate studies, economics, urban planning, and finance.

Students are shown how speculation, market psychology, and the abandonment of economic fundamentals combine to inflate bubbles, and how those same forces ultimately precipitate collapse.

Estimates of the financial losses caused by the Florida Land Boom have varied across historical accounts, and no single official figure exists. Nevertheless, economic historians have established a broadly accepted consensus range.

Historical records indicate that during the early 1920s, speculative land transactions in Florida reached an estimated total value of six to seven billion US dollars in 1920s terms. When the bubble collapsed between 1925 and 1926, direct and indirect losses are estimated at approximately two billion US dollars in contemporary values. This figure appears consistently in American economic history and is regarded as a confirmed historical estimate.

Adjusted for inflation, these losses equate to approximately thirty to thirty-five billion US dollars in present-day terms.

It is important to note that the damage extended far beyond declining land prices. It encompassed widespread bank failures, the cancellation of construction projects, loan defaults, and the prolonged paralysis of Florida’s state economy.

▪️Syed Shayan Real Estate Archive

Section:International Real Estate▪References:

December 1925 editions documenting the peak of the Florida Land Boom, rapid price escalation, and public speculation.

▫️U.S. National Archives and Records Administration

Official records concerning land development, railway expansion, urban planning, and investment patterns in Florida during the 1920s.

▫️Gregg M. Turner

The Florida Land Boom of the 1920s

A definitive historical study analysing the causes, expansion, speculative dynamics, and collapse of the Florida Land Boom.

23 دسمبر 1925

The Florida Land Boom of the 1920s فلوریڈا لینڈ بوم جسے جدید رئیل اسٹیٹ کی تاریخ کا پہلا بڑا ببل قرار دیا جاتا ہے، جب پلاٹ خریدنے والا چند گھنٹوں میں پلاٹ کئی گنا مہنگی قیمت پر دوبارہ بیچ دیتا تھا۔

اگر ہم ٹھیک ایک صدی پیچھے جائیں تو 23 دسمبر 1925 وہ دن تھا جب امریکہ کی رئیل اسٹیٹ تاریخ کا مشہور ترین “فلوریڈا لینڈ بوم” اپنے عروج پر پہنچ چکا تھا۔ فلوریڈا، خصوصاً میامی اور پام بیچ میں لوگوں میں راتوں رات امیر بننے کے لیے زمین خریدنا ایک جنون کی صورت اختیار کر چکا تھا۔

اس وقت صورتحال یہ تھی کہ شہر کے کسی بھی علاقے میں چھوٹے سے چھوٹے پلاٹ کی قیمت چند گھنٹوں میں دگنی ہو جاتی تھی۔ خریدار اکثر پلاٹ دیکھے بغیر ہی ایڈوانس ادا کر دیتے تھے، اور کئی لوگ تو زمین کی رجسٹری ہونے سے پہلے ہی اسے آگے بیچ کر منافع کما رہے تھے۔ رئیل اسٹیٹ ایجنٹس، انوسٹرز اور عام شہری سب اس دوڑ میں شامل تھے، اور ہر کوئی یہ سمجھ رہا تھا کہ قیمتیں کبھی نہیں گریں گی۔

دسمبر 1925 کی اخباری رپورٹس، خصوصاً The Miami Herald کی 23 دسمبر کی اشاعت کے مطابق، صورتحال اس حد تک غیر معمولی ہو چکی تھی کہ کرسمس کی چھٹیوں کے باوجود ہزاروں افراد فلوریڈا میں پلاٹ خریدنے کے لیے قطاروں میں کھڑے تھے۔ ریلوے اسٹیشنوں، بندرگاہوں اور زمینوں کے دفاتر میں رش تھا، اور شہری نظام اس دباؤ کو سنبھالنے سے قاصر نظر آ رہے تھے۔

ماہرین کے مطابق یہ جدید دور کی رئیل اسٹیٹ تاریخ کا پہلا بڑا ببل تھا، جس میں زمین کی قیمتوں کا تعین رہائشی ضروریات اور معاشی بنیادوں (economic fundamentals) کے بجائے قیاس آرائی، افواہوں اور فوری منافع کے لالچ کے تحت کیا گیا۔

تاہم یہ بوم زیادہ دیر قائم نہ رہ سکا۔ 1926 میں آنے والے شدید سمندری طوفان نے فلوریڈا کے کئی علاقوں کو تباہ کر دیا، جس کے بعد سرمایہ کاروں کا اعتماد تیزی سے ٹوٹ گیا۔ اسی دوران معاشی مسائل نے جنم لیا، زمین کی قیمتیں اچانک تیزی سے نیچے گرتی چلی گئیں، اور یوں فلوریڈا کا لینڈ بوم، جو دنیا بھر میں پانچ چھ سال تک دولت اور مواقع کی علامت سمجھا جا رہا تھا، رئیل اسٹیٹ کی دنیا میں تاریخی عبرت کا نشان بن گیا۔

فلوریڈا لینڈ بوم کی اصل کہانی کو اگر سادہ الفاظ میں سمجھا جائے تو تصویر بالکل واضح ہو جاتی ہے۔

اس تصویر میں یہ بورڈ فلوریڈا لینڈ بوم کے دور کی انتہائی گمراہ کن اشتہاری مثال ہے جس میں دلدلی اور پانی میں ڈوبی زمینوں کو “reclaimed” (دوبارہ قابلِ استعمال بنائی گئی زمین) اور “دنیا کی سب سے زرخیز مٹی” قرار دے کر بیچا جا رہا تھا۔ اس زبان کا مقصد زمین کی اصل حالت بتانا نہیں بلکہ خریداروں میں یہ یقین پیدا کرنا تھا کہ ابھی خریدنے سے فوری منافع حاصل ہو گا۔ حقیقت میں ان میں سے بیشتر زمینیں نہ مکمل طور پر خشک تھیں، نہ رہائش یا کاشت کے قابل، مگر “ابھی خریدیں، قیمتیں ابتدائی سطح پر ہیں” جیسے جملوں کے ذریعے قیاس آرائی کو ہوا دی گئی۔ یہی فریب پر مبنی تشہیر فلوریڈا لینڈ بوم کے ببل کی بنیاد بنی، جس نے بعد میں ہزاروں لوگوں کو مالی نقصان سے دوچار کیا

پہلی جنگِ عظیم کے بعد امریکہ میں دولت بڑھی، کاریں عام ہوئیں، ریل اور اشتہارات نے فاصلے ختم کر دیے، اور فلوریڈا ایک خواب کے طور پر پیش کیا جانے لگا جہاں دھوپ، سمندر اور تیزی سے بڑھتے شہر ہر کسی کو امیر بنا سکتے تھے۔ خاص طور پر میامی اور پام بیچ میں زمین صرف رہنے کے لیے نہیں بلکہ فوری منافع کے لیے خریدی جا رہی تھی۔

لوگ زمین دیکھے بغیر، نقشہ تک پڑھے بغیر، صرف افواہوں اور قیمت بڑھنے کی امید پر خرید و فروخت کر رہے تھے۔ ایک پلاٹ صبح خریدا جاتا اور شام تک کئی ہاتھ بدل کر مہنگا ہو جاتا۔ اس مرحلے پر زمین اثاثہ نہیں بلکہ دولت کمانے کا ایک سرٹیفیکیٹ بن چکی تھی، جس پر سب کو یقین تھا کہ قیمت کبھی نیچے نہیں آئے گی۔

اصل مسئلہ یہ تھا کہ زیادہ تر خریدار وہاں گھر بنانے یا آباد ہونے نہیں جا رہے تھے۔ وہ صرف اگلے خریدار کا انتظار کر رہے تھے۔ جیسے ہی نئے خریداروں کی رفتار کم ہوئی، پورا نظام ہلنا شروع ہو گیا۔ 1925 کے آخر تک ریل کا نظام جام ہو گیا، کیونکہ سیمنٹ، لکڑی اور روزمرہ اشیا کی جگہ صرف زمین کی دستاویزات ہی سفر کر رہی تھیں۔ بینکوں نے قرض دینا سست کر دیا، خریدار غائب ہونے لگے، اور پہلی بار قیمتیں رکیں۔ یہی وہ لمحہ تھا جب ببل پھٹنے کے آثار ظاہر ہوئے۔

1926 میں دو فیصلہ کن واقعات نے اس عمل کو ناقابلِ واپسی بنا دیا۔ پہلے، میامی میں ایک شدید سمندری طوفان آیا جس نے ہزاروں تعمیرات تباہ کر دیں، بندرگاہیں مفلوج ہو گئیں، اور یہ واضح ہو گیا کہ شہر جس رفتار سے بیچا جا رہا تھا، اس رفتار سے محفوظ یا تیار ہی نہیں تھا۔ دوسرے، بینکوں اور ڈویلپرز کا اعتماد ٹوٹ گیا۔ جیسے ہی ادائیگیاں رکیں، قسطیں ڈیفالٹ ہوئیں، اور زمین کی وہی فائلیں جنہیں لوگ دولت سمجھ رہے تھے، بوجھ بن گئیں۔ بہت سے افراد جنہوں نے قرض لے کر زمین خریدی تھی، سب کچھ کھو بیٹھے۔

نتیجہ یہ نکلا کہ فلوریڈا کی زمینوں کی قیمتیں بعض علاقوں میں پچاس سے ستر فیصد تک گر گئیں۔ ہزاروں منصوبے ادھورے رہ گئے، بینک بند ہوئے، اور فلوریڈا کی معیشت کئی برس پیچھے چلی گئی۔ اہم بات یہ ہے کہ یہ سب 1929 کے گریٹ ڈپریشن سے تین سال پہلے ہو چکا تھا۔ اسی لیے ماہرین اسے جدید رئیل اسٹیٹ تاریخ کا پہلا بڑا قیاس آرائی پر مبنی ببل مانتے ہیں، کیونکہ یہاں وہ تمام عناصر واضح تھے جو بعد میں دنیا بھر میں دہرائے گئے، یعنی افواہوں پر خرید، حقیقی طلب کی عدم موجودگی، آسان منافع کا یقین، اور نظامی اعتماد کا اچانک خاتمہ۔

فلوریڈا لینڈ بوم سے حقیقی سبق یہ ملتا ہے کہ چند منافع خوروں نے زمین کو رہائش اور اثاثے کے بجائے ایک تیز رفتار سٹے کی چیز بنا دیا تھا۔ جب خریدار صرف اگلے خریدار پر یقین کرنے لگے اور اصل استعمال پس منظر میں چلا جائے، تو قیمتیں اوپر تو جا سکتی ہیں مگر وہاں ٹھہر نہیں سکتیں۔ یہی وہ بنیادی حقیقت ہے جسے سمجھنے کے لیے آج امریکہ اور دیگر ممالک کی جامعات میں اسے رئیل اسٹیٹ، معاشیات، اربن پلاننگ اور فنانس کے مضامین میں بطور کیس اسٹڈی (case study) پڑھایا جاتا ہے۔ اس مثال کے ذریعے طلبہ کو یہ سمجھایا جاتا ہے کہ کس طرح قیاس آرائی، مارکیٹ نفسیات اور حقیقی معاشی بنیادوں سے ہٹ کر قیمتوں میں تیزی ببل (bubble) کو جنم دیتی ہے، اور پھر یہی عوامل اچانک زوال کا سبب بنتے ہیں۔

فلوریڈا لینڈ بوم کے مالی نقصان کے بارے میں تاریخ میں اندازے بہت دہرائے گئے ہیں، مگر ایک واحد، قطعی اور سرکاری عدد کہیں بھی موجود نہیں۔ اس کے باوجود، تاریخ دانوں اور معاشی محققین نے ایک متفقہ حد (consensus range) طے کی ہے جو معتبر سمجھی جاتی ہے۔

تاریخی ریکارڈ کے مطابق، 1920 کی دہائی میں فلوریڈا لینڈ بوم کے دوران زمین کی قیاس آرائی پر مبنی خرید و فروخت کی مجموعی مالیت تقریباً 6 سے 7 ارب ڈالر (1920s dollars) تک جا پہنچی تھی۔ جب 1925 اور 1926 میں یہ ببل ٹوٹا تو براہِ راست اور بالواسطہ مالی نقصانات کا تخمینہ تقریباً 2 ارب ڈالر (1920s dollars) لگایا گیا۔ یہ عدد امریکی اقتصادی تاریخ میں بار بار درج ہوا ہے اور اسے confirmed historical estimate مانا جاتا ہے۔

اگر ہم اس رقم کو آج کی قدر میں سمجھیں تو افراطِ زر کو مدنظر رکھتے ہوئے یہ نقصان تقریباً 30 سے 35 ارب امریکی ڈالر (current value) کے برابر بنتا ہے۔

یہ بات بھی اہم ہے کہ یہ نقصان صرف زمین کی قیمت گرنے تک محدود نہیں تھا۔ اس میں شامل تھے:

⁃ بینکوں کی ناکامیاں

⁃ تعمیراتی منصوبوں کی منسوخی

⁃ قرضوں کی نادہندگی

⁃ فلوریڈا کی ریاستی معیشت کا مفلوج رہنا

▪️سید شایان ریئل اسٹیٹ آرکائیو

حوالہ جات

▫️ The Miami Herald (1925 Archives)

دسمبر 1925 کی اشاعتیں، فلوریڈا لینڈ بوم کے عروج، زمین کی قیمتوں میں تیزی اور عوامی جنون سے متعلق براہِ راست اخباری رپورٹس۔

▫️ U.S. National Archives and Records Administration (NARA)

1920 کی دہائی میں فلوریڈا کی زمین، ریل کی توسیع، شہری منصوبہ بندی اور سرمایہ کاری سے متعلق سرکاری ریکارڈز اور معاشی رپورٹس۔

▫️ Gregg M. Turner

The Florida Land Boom of the 1920s

مستند تاریخی کتاب، جس میں فلوریڈا لینڈ بوم کے اسباب، پھیلاؤ، قیاس آرائی اور زوال کا تفصیلی تجزیہ شامل ہے۔

No comments yet. Be the first to comment!